Investment Principles

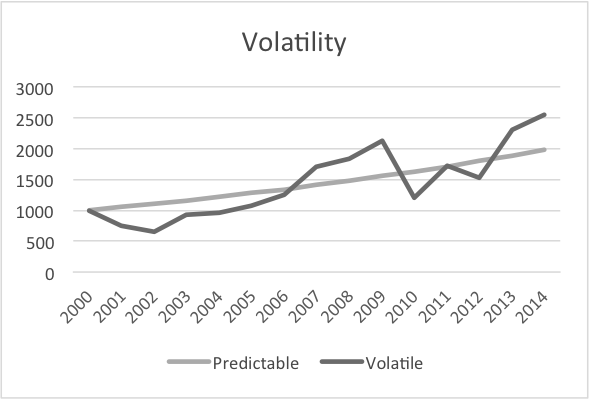

With investment generally the more risk you are prepared to take, the greater the potential for higher returns over the long term, however higher risk can bring with it greater volatility (which can be scary for the inexperienced investors and can lead to difficult decisions being taken should investments fall unexpectedly.

Investing in cash and bonds to deliver a predictable return may seem prudent but over the long-term inflation could wipe out any gains you make whereas investing in property and shares is likely to give you a return over the long-term significantly above inflation making your money work harder for you but you have to live with the increased volatility.

Investing in cash and bonds to deliver a predictable return may seem prudent but over the long-term inflation could wipe out any gains you make whereas investing in property and shares is likely to give you a return over the long-term significantly above inflation making your money work harder for you but you have to live with the increased volatility.

Combining different types of investment (property, shares, bonds and cash) via an asset allocation model can help to even out these swings in value, especially if they are "non-correlated" (i.e. their prices move independently). This is why it usually makes sense for investors to have some exposure to bonds and cash even though their long-term potential is less than that of property and shares.

The asset allocation of a portfolio has a direct impact on the level of risk as does the timeframe for investment. If you have need for the money in three years’ time, you should take much less risk than if you intend to invest for twenty years.

We will help determine the risk you are prepared to take, talk about the options for maximising your return within your risk tolerance and then select a suitable portfolio with you. Our investment solution will reflect your financial goals, attitude to risk and your investment timeframe. We can invest in a range of asset classes, spreading your investments and thereby reducing your risk.

Also See:

THE VALUE OF INVESTMENTS AND INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.

PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE PERFORMANCE.

We offer a range of services to help you meet your investment and / or retirement objectives. We provide Independent investment advice; this is also outlined within our important information about our services document which we will discuss with you.

We have investment and saving's clients from Durham and the surrounding areas, including Ferryhill, Darlington, Hartlepool, Middlesbrough, Sunderland and Newcastle Upon Tyne.

If you are looking for investment and savings advice in the County Durham area, contact us today.